Most homeowners install solar panels to lower their electric bills.

What many don’t realize is that solar can also increase a home’s market value — sometimes by thousands of dollars.

However, not all solar systems are treated equally in real estate.

One critical factor determines whether your solar becomes real equity or simply a utility savings feature:

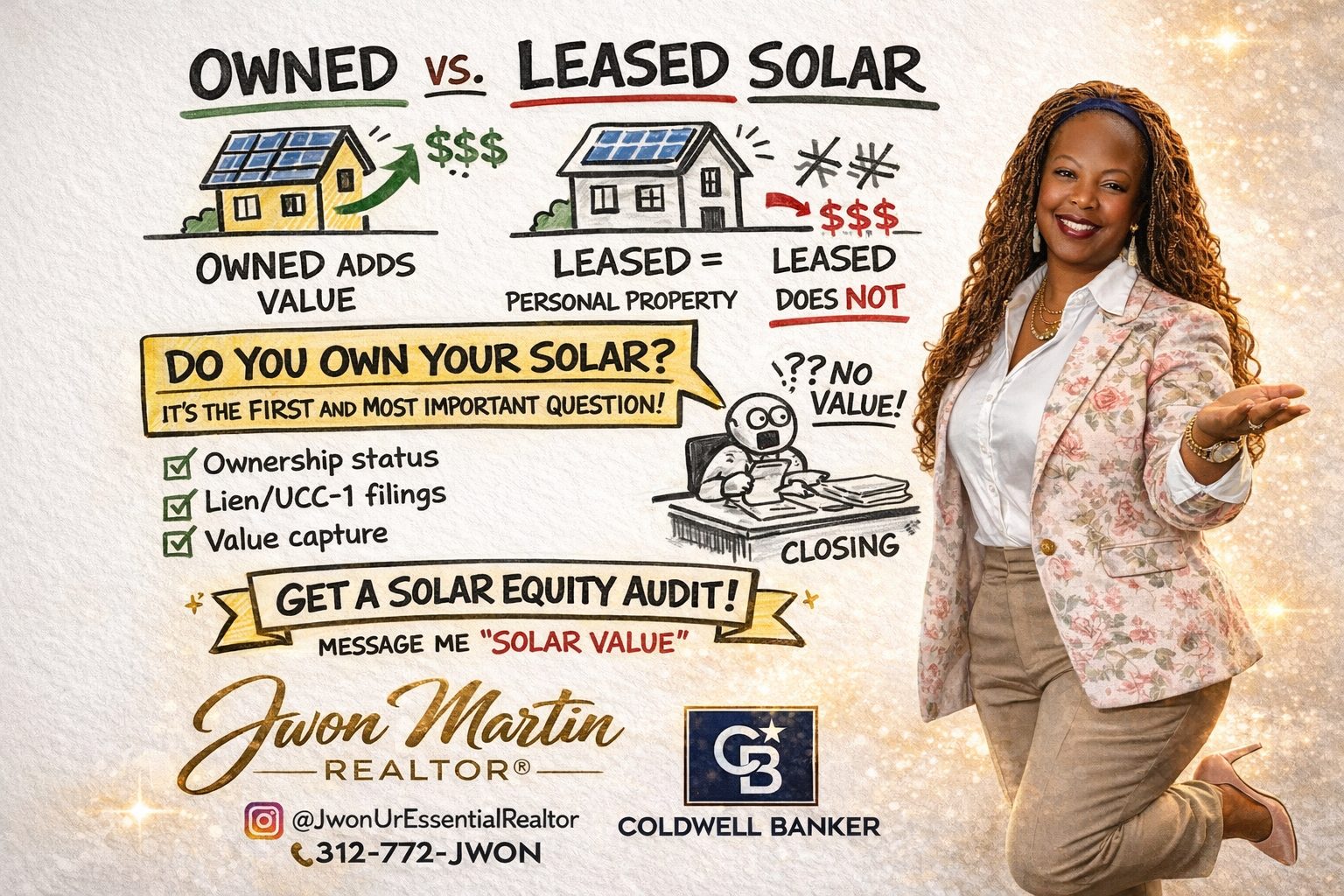

Do you own your solar system, or is it leased?

That single detail can dramatically affect how your home is appraised, marketed, and ultimately sold.

Let’s break it down.

What Owned vs. Leased Solar Means

Owned Solar

An owned solar system means you either:

- Paid cash for the system, or

- Financed the system with a loan

In both cases, the solar equipment belongs to you.

Because you own the system, it is typically considered part of the real property — similar to a roof, HVAC system, or built-in appliance.

This opens the door for solar to contribute to your home’s appraised value.

Leased Solar / Power Purchase Agreement (PPA)

With a lease or PPA:

- A third-party company owns the solar panels

- You pay a monthly fee to use the power produced

Since you do not own the equipment, the system is generally classified as personal property, not real property.

That distinction matters.

Personal property usually does not add to home value.

How Appraisers Treat Each

Appraisers rely on ownership status, documentation, and comparable sales to assign value.

Owned Solar

When properly documented:

- May be valued as part of the home

- Can contribute to higher appraised value

- Supports stronger pricing and negotiation power

Specialized valuation tools (such as PV Value) can even estimate how much additional equity the system contributes based on local energy rates and system performance.

Leased Solar

Typically:

- Receives little to no contributory value

- Is often excluded from appraisal calculations

- Must be addressed separately in the transaction

Even worse, some buyers hesitate to assume a lease, which can shrink the buyer pool.

Risks at Resale

Many sellers are shocked when they discover their solar system is not increasing value the way they expected.

Common risks include:

- Buyer resistance to assuming lease payments

- Delays caused by transfer approvals from solar companies

- Surprise liens (UCC-1 filings) attached to solar loans

- Lost negotiation leverage

These issues can surface late in the transaction, creating stress and sometimes forcing price concessions.

How to Check Your Solar Ownership Status

Start by locating:

- Your original solar contract

- Loan or lease agreement

- Any financing documents

Look for language indicating:

- “Purchase,” “Loan,” or “Finance” = Owned

- “Lease” or “Power Purchase Agreement” = Not owned

If you’re unsure, a title search or UCC-1 lien check can clarify whether a lender has a secured interest in the system.

How the Solar Equity Audit Helps

This is exactly why I created the Solar Equity Audit.

It is a complimentary review designed to help homeowners understand:

- Ownership status

- Whether liens or UCC-1 filings exist

- What documentation is needed

- Whether their solar is positioned to add value

- Opportunities to protect and maximize equity

Instead of guessing, you get clarity.

Instead of assumptions, you get a plan.

The Bottom Line Solar can be a powerful wealth-building tool.

But only when it is:

Owned. Documented. Properly Presented.

If you have solar — or are considering buying a home with solar — the first question isn’t how many panels you have.

It’s:

Do you own them?

If you’d like to understand what your solar system is really worth and how to protect its value:

👉 Request your complimentary Solar Equity Audit today.

Your solar is an asset.

Let’s make sure it’s treated like one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link